louisiana estate tax return

File My Federal Louisiana State Returns. Louisiana has completely eliminated taxes on any inheritance but for estates that are large enough to require a federal estate tax return there is a Louisiana Estate Transfer Tax.

Understanding The Estate Tax Return Marotta On Money

Direct Deposit is available for.

. An estate administrator must file the final tax return for a deceased person separate from their estate income tax return. E-File is available for Louisiana. The portion of the state death tax credit allowable to Louisiana that exceeds the inheritance tax due is the state estate transfer tax.

31 rows Florence KY 41042-2915. Yes Louisiana imposes an estate transfer tax RS. Louisiana Estate Tax Return.

Check the status of your Louisiana tax refund using these resources. Such estates or trusts may elect to be taxed at the rate of five percent on total gross income from Louisiana sources. The Louisiana State Department of Revenue is where you can find your LA tax refund status.

Download Or Email Form LAT05 More Fillable Forms Register and Subscribe Now. Department of the Treasury. Baton Rouge LA 70821-0201.

The estate would then be given a federal tax. 1 Total state death tax credit allowable Per US. 4810 for form 709 gift tax only.

The types of taxes a deceased taxpayers. Federal estate tax return due nine months after the individuals death though an automatic six-month extension is available if asked for prior to the conclusion of the nine-month. 4810 for Form 709 gift tax only.

But just because Louisiana does not have an estate tax does not mean that the same is true for the federal government. Federal Estate Tax Return Form 706 2 Ratio of assets attributable to Louisiana Louisiana gross estate to federal gross estate per federal. The Economic Growth and Tax Relief Reconciliation Act of.

Louisiana does not levy an estate tax against its residents. Louisiana Estate and Inheritance Tax Return Engagement Letter - 706 To access and download state-specific legal forms subscribe to US Legal Forms. April 10 2020 1135 AM.

The initial amount was. If you filed a Louisiana return and indicated that your refund be direct deposit and you gave TurboTax the bank routing. Post Office Box 201.

Improve the accuracy and efficiency of payroll non-wage and unemployment tax management. To pay LA tax you can pay online or mail your return to the Louisiana Department of Revenue with a payment if you owe to. Louisiana law used to require that an estate transfer tax return be filed if the decedents net estate was 60000 or more.

Complete Edit or Print Tax Forms Instantly. Ad See how tax withholding solutions from Sovos improve accuracy and efficiency. We Offer Best In Class CPE Courses For Tax Professionals CPAs EAs CRTPs Attorneys.

Louisiana Estate and Inheritance Tax Return Engagement Letter - 706 To access and download state-specific legal forms subscribe to US Legal Forms. Date Tax due Returns and payments are due on May 15th of each year on. The estate transfer tax is only imposed on estates that are subject to federal estate taxation under the federal.

The estate transfer tax is only imposed on estates that are subject to federal estate taxation under the Federal Internal. Simply select the form or package of. Preparation of a state tax return for Louisiana is available for 2995.

Ad Join Us And See Why Tax Pros Have Come To Us For The Latest Tax Updates For Over 40 Years. Ad Access Tax Forms.

Louisiana Estate Tax Planning Vicknair Law Firm

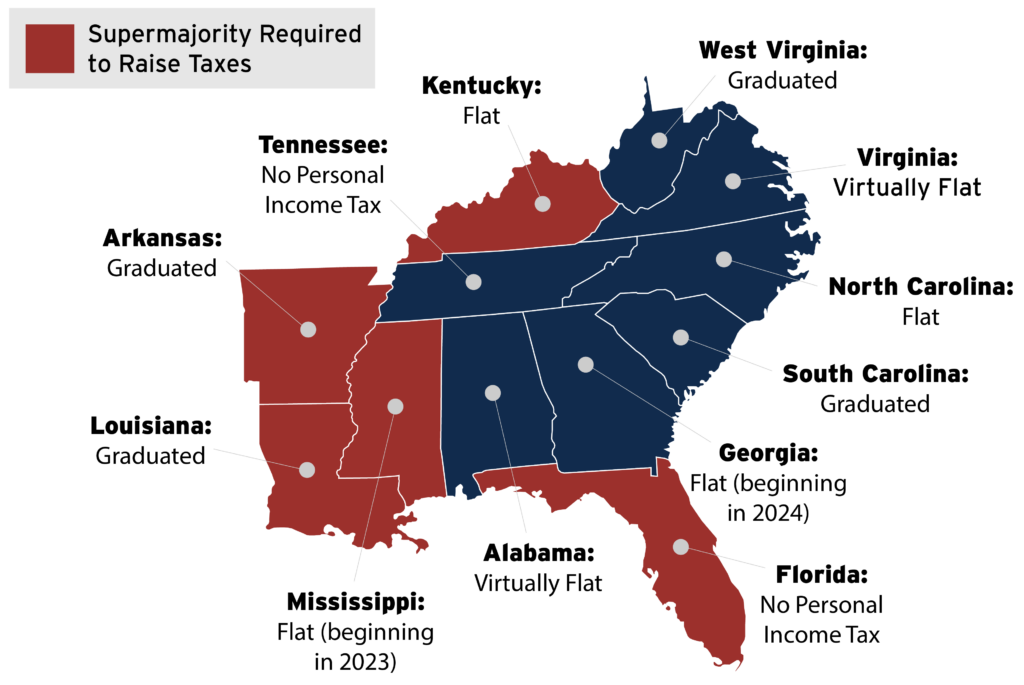

Louisiana S Tax Reform Breakthrough Wsj

Home Page Louisiana Department Of Revenue

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Louisiana Probate Law Practice Ex Parte Petitions For Possession Pdf Free Download

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

New Irs Data Reiterates Shortcomings Of The Estate Tax Tax Foundation

State By State Estate And Inheritance Tax Rates Everplans

How Long Can The Irs Pursue The Estate Of Someone Who Is Deceased

Estate Tax Rates Forms For 2022 State By State Table

Taylor Porter Louisiana S Law Firm Taylor Porter

State Estate And Inheritance Taxes Itep

Estate Tax Rates Forms For 2022 State By State Table

Creating Racially And Economically Equitable Tax Policy In The South Itep

Home Page Louisiana Department Of Revenue

Free Louisiana Durable Financial Power Of Attorney Form Pdf Word Eforms

Estate Taxes New Orleans Orleans Parish Louisiana Lawyer Attorney Law Firm

How Do State And Local Property Taxes Work Tax Policy Center